글로벌 세계로 나아가기

글로벌 세계로 나아가기이란 무엇인가요?

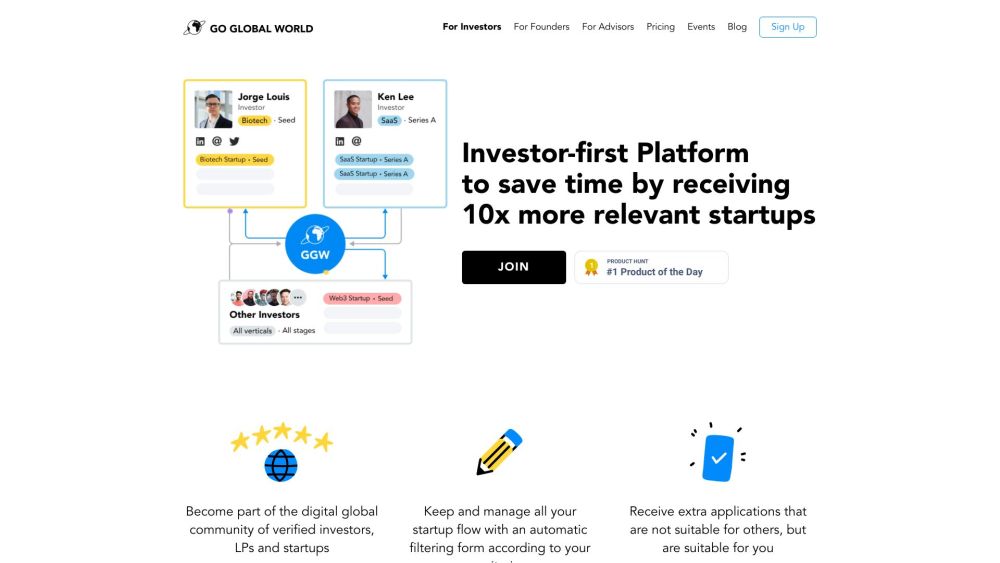

글로벌 세계로 나아가기는 투자자를 최우선으로 하는 플랫폼으로, 투자자들에게 더 관련성 높은 스타트업 기회를 제공하여 시간을 절약하도록 돕습니다. 이 플랫폼은 검증된 투자자, LP 및 스타트업으로 구성된 디지털 글로벌 커뮤니티에 참여할 수 있으며, 투자자의 기준에 따라 자동 필터링을 통해 스타트업 흐름을 관리하고 전 세계의 스타트업에 접근할 수 있습니다. 또한, 이 플랫폼은 스타트업 스카우팅, 전문가의 독립적인 의견 및 지속 가능한 성장을 이룬 자금 확보 단계에 있는 스타트업에 대한 접근과 같은 기능도 제공합니다.

글로벌 세계로 나아가기을 어떻게 사용하나요?

글로벌 세계로 나아가기를 사용하려면 투자자로 가입하여 프로필을 만듭니다. 그런 다음 스타트업 매칭을 위한 기준을 설정하고 선호에 따라 자동 스카우팅을 받을 수 있습니다. 이 플랫폼은 스타트업 지원서, 투자자 업데이트 및 거래 흐름을 추적하기 위한 대시보드를 제공합니다. 투자자는 또한 전용 거래 흐름에 접근하고 내장된 메신저를 통해 글로벌 투자자와 연결되며 네트워크를 확장할 수도 있습니다. 추가로, 투자자는 글로벌 데모 데이 및 글로벌 세계로 나아가기 이벤트에 참여하여 잠재적인 투자 대상인 스타트업을 발견하고 평가할 수 있습니다.

글로벌 세계로 나아가기의 핵심 기능

투자자 기준에 따른 자동 스타트업 지원서 필터링

전 세계의 스타트업에 대한 접근

개인 기준에 따른 스타트업 스카우팅과 매일 업데이트

검증된 투자자, LP 및 스타트업과 연결할 수 있는 기회

스타트업 흐름, 투자자 업데이트 및 거래 흐름 관리용 대시보드

자금 확보 단계와 지속 가능한 성장을 이룬 스타트업에 대한 접근

글로벌 세계로 나아가기 전문가의 독립적인 의견

피치 세션과 투자 기회를 위한 글로벌 데모 데이 및 글로벌 세계로 나아가기 이벤트

네트워킹 및 토론을 위한 폐쇄된 투자자 커뮤니티

스타트업 및 투자자와의 커뮤니케이션을 위한 내장 메신저

글로벌 세계로 나아가기의 사용 사례

시간을 절약하고 관련성 높은 스타트업 기회를 받기를 원하는 투자자들

글로벌 네트워크를 확장하고 미래 거래와 자금 조달을 위해 관계를 구축하려는 투자자들

피치 세션에 참여하고 유망한 스타트업을 발견하려는 투자자들

지속 가능한 성장과 자금 확보 단계를 지닌 스타트업을 찾는 투자자들

스타트업 흐름을 효율적으로 관리하고 투자자 업데이트를 받기 위한 효율적인 플랫폼이 필요한 투자자들

글로벌 세계로 나아가기의 FAQ

플랫폼에 접근할 수 있는 대상은 누구인가요?

사전 검증 과정은 얼마나 걸리나요?

등록되지 않은 사용자와 프로필을 공유할 수 있나요?

플랫폼에서 어떻게 매칭 메커니즘 작동하나요?

무료로 플랫폼에 접속하면 어떤 일이 발생하나요?

기존 플랫폼에 등록되어 있었다면 다시 등록해야 하나요?

글로벌 세계로 나아가기 지원 이메일 및 고객 서비스 연락처 및 환불 연락처 등

다음은 고객 서비스를 위한 글로벌 세계로 나아가기 지원 이메일입니다: [email protected] .

글로벌 세계로 나아가기 회사

글로벌 세계로 나아가기 회사 이름: Go Global World .

글로벌 세계로 나아가기 로그인

글로벌 세계로 나아가기 로그인 링크: https://app.goglobal.world/login

글로벌 세계로 나아가기 가입

글로벌 세계로 나아가기 가입 링크: https://app.goglobal.world/sign-up

글로벌 세계로 나아가기 가격

글로벌 세계로 나아가기 가격 링크: https://www.goglobal.world/investors/plans/

글로벌 세계로 나아가기 Facebook

글로벌 세계로 나아가기 Facebook 링크: https://www.facebook.com/GoGlobalWorld1/

글로벌 세계로 나아가기 Linkedin

글로벌 세계로 나아가기 Linkedin 링크: https://www.linkedin.com/company/go-global-world/

글로벌 세계로 나아가기 Twitter

글로벌 세계로 나아가기 Twitter 링크: https://twitter.com/GoGlobalWorld

글로벌 세계로 나아가기 리뷰(0)

글로벌 세계로 나아가기 가격

스카우트

$1188

회원 및 투자자 프로필, 스타트업 및 투자자와 매칭 가능: 무제한 데이터베이스, 무제한 연결 요청, 메신저. 하루에 10개의 연결 요청 및 저장. 공유용 프로필 링크. 대시보드. 관련 스타트업 및 거래 알림

투자자

$4188

스카우트 플랜의 모든 기능. 무제한 연결 요청 및 저장. 투자자 및 LP 데이터베이스(5천개 이상). 프로필 검증. 플랫폼 내 블로그 기고. 뉴스레터에 피쳐링. GGW 서비스 10% 할인

프리미엄

사용자 맞춤형

투자자 플랜의 모든 기능. 개인 매니저. 맞춤형 접근

최신 가격을 확인하려면 다음 링크를 방문하세요: https://www.goglobal.world/investors/plans/

소셜 리스닝